Bi weekly paycheck tax calculator

Get your payroll done right every time. The size of your paycheck is also affected by your pay frequency.

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

Computes federal and state tax withholding for.

. You can use the calculator to compare your salaries between 2017 and 2022. Ad Payroll So Easy You Can Set It Up Run It Yourself. That means that your net pay will be 37957 per year or 3163 per month.

Ad Compare This Years Top 5 Free Payroll Software. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. The remainder is subject to withholding tax at the rate in the appropriate section below.

Big on service small on fees. SmartAssets Missouri paycheck calculator shows your hourly and salary income after federal state and local taxes. Ad Compare This Years Top 5 Free Payroll Software.

You can calculate your Weekly take home pay based of your Weekly gross income and the tax allowances tax credits and tax brackets as defined in the 2022 Tax Tables. We use the most recent and accurate information. If you would like the paycheck calculator to calculate your gross pay for you enter your hourly rate regular hours overtime rate and overtime hours.

Effective 01012018 Single Person including head of household SUBTRACT 15960. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees. Free Unbiased Reviews Top Picks.

Ad Create professional looking paystubs. Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Ad Fast Easy Accurate Payroll Tax Systems With ADP.

Ad Run your business. All Services Backed by Tax Guarantee. Your average tax rate is.

It can also be used to help fill steps 3. Over 900000 Businesses Utilize Our Fast Easy Payroll. The calculator is updated with the tax rates of all Canadian provinces and.

As of Aug 8 2022 the. Well run your payroll for up to 40 less. Free Unbiased Reviews Top Picks.

Biweekly Weekly Day Hour Withholding Salary 52000 Federal tax deduction - 5185 Provincial tax deduction - 2783 CPP deduction - 2643 EI deduction - 822 Total tax - 11432 Net pay. As of Aug 8 2022 the. In a few easy steps you can create your own paystubs and have them sent to your email.

Learn About Payroll Tax Systems. Ad Keep your finances organized and compliant with government regulations. Simply enter their federal and state W-4 information as well as their.

Using a 30 hourly rate an average of eight hours worked each day and 260 working days a year 52 weeks multiplied by 5 working days a week the annual unadjusted salary can be. Sign Up Today And Join The Team. Easy to use software that is tailored specifically for small businesses.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043.

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

Paycheck Calculator Take Home Pay Calculator

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

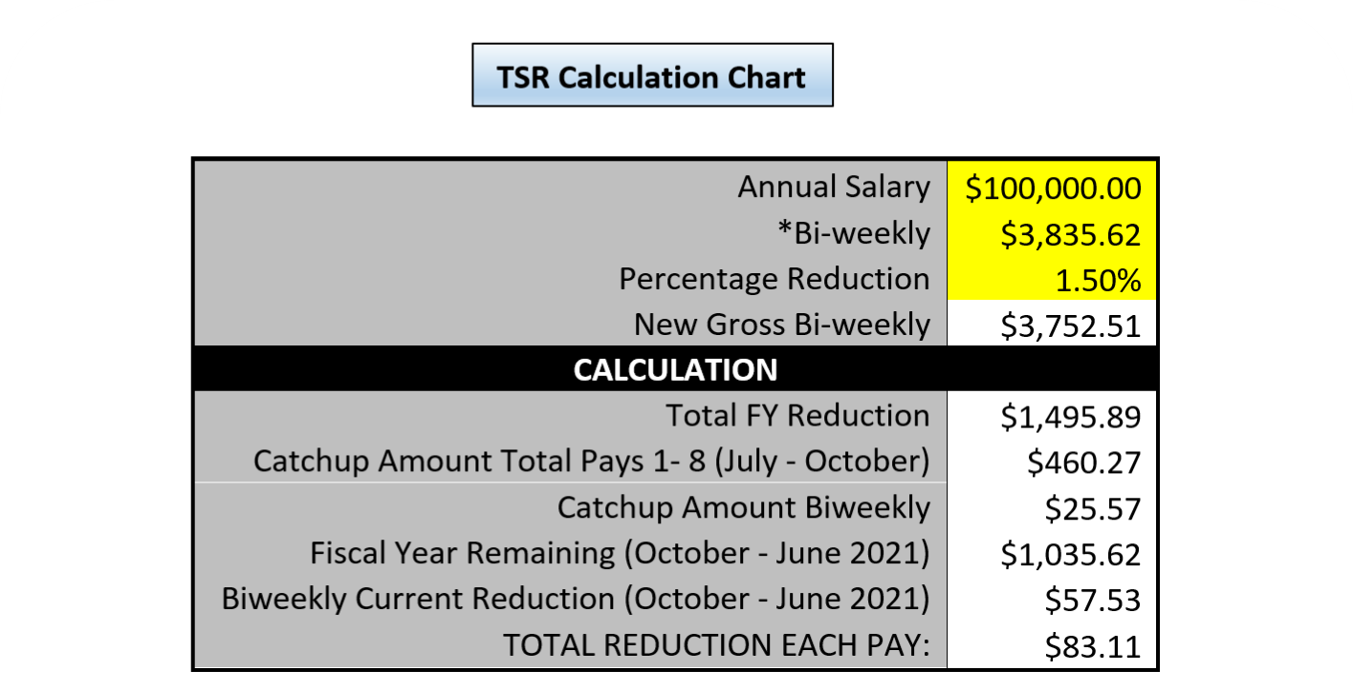

Temporary Salary Reduction Human Resources Umbc

2022 Biweekly Payroll Calendar Template For Small Businesses Hourly Inc

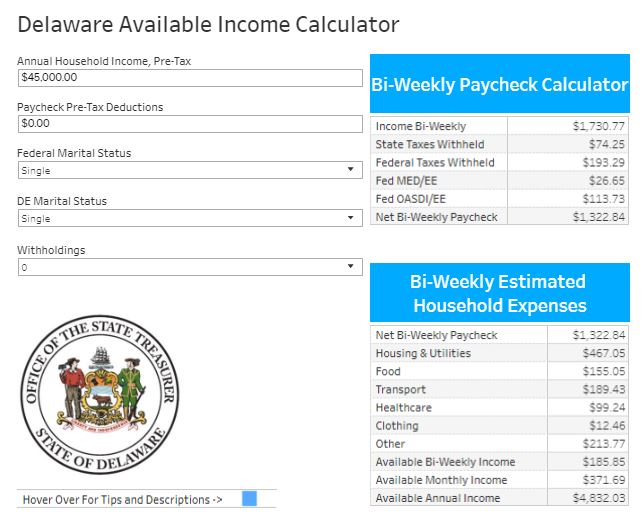

Delaware Available Income Calculator State Treasurer Colleen C Davis State Of Delaware

If You Make 130 000 Year In Nyc What Is Your Take Home Bi Weekly Payment Quora

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Free Online Paycheck Calculator Calculate Take Home Pay 2022

4 Ways To Calculate Annual Salary Wikihow

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

How To Calculate Payroll Taxes Methods Examples More

Paycheck Calculator Take Home Pay Calculator

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

The Pros And Cons Biweekly Vs Semimonthly Payroll

Hourly Wage To Biweekly Paycheck Converter Hourly Salary Conversion Calculator